In May 2024, the cryptocurrency market experienced robust activity and significant advancements, particularly in regulatory aspects and market dynamics. The approval of a Spot Ethereum ETF notably boosted market confidence, setting a positive tone for the month. This was followed by the BTC ETF’s AUM rebounding to $60 billion. The stablecoin sector showed mixed performance, with USDC and FDUSD issuance dropping, while USDe reached new heights. Public chains and Layer2 solutions like Base and Linea saw significant inflows. Despite a slight monthly investment decline, year-over-year growth remained positive, highlighting the sector’s ongoing potential.

Market Sentiment Soars with Ethereum Spot ETF Approval, AUM for BTC ETF Rebounded to $60 Billion

In mid-May 2024, global economic data and events reignited optimism about potential US monetary policy adjustments. This renewed confidence, alongside a strong earnings report from NVIDIA, increased interest in technology stocks and the AI sector. The broader crypto market also rebounded, driven by the unexpected approval of a critical Ethereum Spot ETF document. Although the ETF has not yet attracted capital inflows, the announcement significantly boosted market sentiment, enhancing confidence in Ethereum and its ecosystem.

The market, previously subdued, experienced a notable sentiment shift. Bitcoin spot ETFs’ total assets under management (AUM) bounced back to $60 billion, reflecting renewed investor interest. Additionally, BTC contract open interest surged, reaching earlier high levels, while BTC options open interest rose cautiously. Looking forward, June is anticipated to be eventful with the upcoming FOMC meeting and potential impacts on market liquidity as the Federal Reserve revises its securities holdings strategy.

Trending in Crypto: Rise of Attention Assets

The cryptocurrency market is increasingly favoring attention assets like character and celebrity meme tokens due to their growth potential. This trend indicates a shift away from projects with high initial valuations that limit retail price discovery and wealth generation. Notcoin is a prime example of the current market trend, driving substantial increases in both price and trading volume.

Mixed Performance in Fiat-Collateralized Stablecoin Issuance

In May 2024, fiat-collateralized stablecoin issuance decreased by $840 million, mainly due to declines in USDC and FDUSD. Data from SosoValue and Glassnode indicated upward trends for USDT and PYUSD, while USDC, DAI, and TUSD saw reductions. PYUSD rose by 21.7% and announced issuance on Solana, potentially impacting Solana’s ecosystem. USDe’s issuance skyrocketed to $2.978 billion, overtaking FDUSD to become the fourth-largest stablecoin. FDUSD issuance dropped from 4.25 billion on April 30 to 2.92 billion on May 31, a 31.29% decline, contrasting with the stability of USDT and USDC.

Drop in ETH Layer2 Activity Despite Market Recovery

Despite a 21% monthly increase in ETH prices, ETH Layer2 TVL denominated in ETH fell by 4.4%, indicating stagnant activity levels. However, USD-denominated TVL rose by over 20% due to market recovery. The surge in ETH prices didn’t lead to more funds in the ETH Layer2 ecosystem, which slightly declined to 12.38 million ETH, while USD-denominated TVL reached $47.81 billion.

Base and Linea Thrive Despite Layer2 Sector Challenges

Despite a pessimistic outlook for the ETH Layer2 sector, Base and Linea saw significant growth. While high-performance blockchains and low on-chain fees lost appeal, meme coins and Restaking gained traction. Base’s ecosystem demonstrated heightened activity, while Linea attracted substantial capital inflows. This growth was driven by the popularity of meme coins and Restaking narratives, with FOXY and Renzo protocol playing significant roles.

Robust Performance in ETH-Based Blockchains and BTC Ecosystem’s Merlin

With Ethereum’s price rebound, ETH-based blockchains like Arbitrum and Base showed strong USD-denominated TVL performance. The ETH recovery spurred increased activity in meme assets related to the U.S. presidential election on Ethereum. Meanwhile, in the BTC ecosystem, Merlin’s TVL surged over 100% in the past month, driven by Solv Funds’ Bitcoin-wide base yield dividend protocol. However, Merlin’s native token saw limited volume and price increases due to a lack of practical applications and positive stimuli.

LayerZero’s Sybil Screening Measures Ignite Crypto Community

In early May 2024, LayerZero Labs initiated a 14-day Self-Report Sybil Activity program, encouraging users to report Sybil behaviors in exchange for rewards. The program, offering 15% of expected allocation to self-reporters, significantly increased anti-Sybil efforts, leading to widespread mutual reporting fueled by economic incentives. Notable events included employees resigning to report internal accounts and large airdrop addresses being exposed.

Notcoin’s Success Enhances TON Ecosystem

Notcoin, a mini-game on the TON blockchain, quickly gained traction, reaching 6 million daily active users and a market cap of $2.2 billion within three months. Its “Tap to Earn” model leverages Web3’s openness and Telegram integration to reduce customer acquisition costs. Another TON game, Catizen, also experienced rapid growth with over 6 million users and 8.1 million transactions, boosting the ecosystem’s activity and liquidity.

Runes Dominate BTC Transactions While BRC20 Struggles

In May 2024, the Bitcoin derivative asset market experienced a noticeable pivot towards RUNES and BTC Layer2 solutions, along with BTC staking/re-staking and shared security sectors. During this period, BRC20 Ordinals faced challenges in maintaining significant traffic and growth. The emergence of new technologies and narratives introduced by developers is now challenging the previously dominant position of Ordinals/BRC20 within the BTC native asset space, highlighting the need for continued innovation to regain market traction.

DOG (Runes) Gains Strength, Challenging ORDI’s Market Dominance

Within the Runes ecosystem, the DOG asset showed impressive market performance, with its market capitalization nearing $800 million by the end of May. This surge was driven by favorable market conditions. In contrast, ORDI experienced some volatility but rebounded to a $1 billion market capitalization by May 31, 2024, maintaining a lead over DOG. Despite ORDI’s recovery, the momentum in terms of users, developers, and overall traffic continued to shift away from Ordinals/BRC20 and towards the burgeoning RUNES ecosystem.

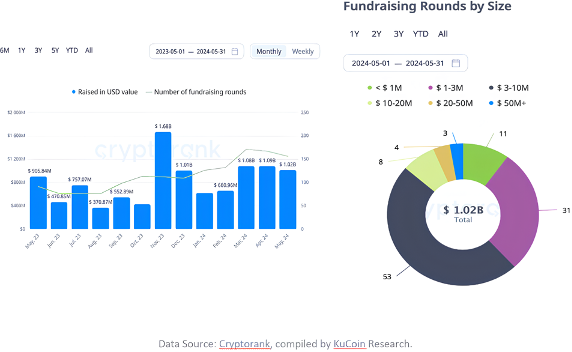

Dynamic Trends in Crypto Investments

In the past month, the cryptocurrency market announced 156 investment and financing projects, amounting to a total of $1.02 billion. Although this represents a slight decline from April 2024, it signifies an increase compared to the same period last year. Notably, over 50% of these projects secured financing in the range of $1 million to $10 million.

Shifts in Investment Focus with Strategic Round Financing on the Rise

In May 2024, the cryptocurrency market saw a shift in investment dynamics. The proportion of Series A investments decreased from 10% to 7.77%, while strategic round financing projects rose from 15.73% to 18.45%. This trend suggests a growing preference for projects to aim for public listings. Meanwhile, seed round investments remained relatively stable.

EVM-Based Blockchains Lead Financing Popularity

Ethereum, EVM-compatible chains, and Layer 2 solutions continued to dominate the public blockchain ecosystems with the highest number of projects. Among non-EVM chains, Solana maintained its position in the top five, Fantom entered the top ten, and TON’s ranking improved, underscoring their increasing significance in the market.

Türkiye Plans New Cryptocurrency Regulation Law

Türkiye is set to introduce a new law to regulate cryptocurrency assets, aligning with international regulatory standards and initiating taxation on cryptocurrency transactions. This legislation aims to mitigate the risks associated with cryptocurrency trading. The Capital Markets Board will enforce stringent regulations on the licensing and operation of cryptocurrency trading platforms. This initiative has received strong backing from Mehmet Şimşek, Türkiye’s Minister of Finance.

About WOW EARN Research

WOW EARN Research is a premier provider of research and analysis in the cryptocurrency sector. With a team of seasoned analysts and researchers, WOW EARN Research delivers high-quality insights and reports to empower investors and industry professionals.

General Disclosure

1. The content in this report is intended solely for informational purposes and should not be used as the basis for making investment decisions. It should not be interpreted as a recommendation to engage in investment transactions or as an indication of any investment strategy regarding financial instruments or their issuers.

2. This report, provided by WOW EARN Research, does not offer advisory services related to investments, taxes, legal matters, finances, accounting, consulting, or any other similar services. The information provided should not be construed as recommendations to buy, sell, or hold any assets.

3. The information presented in this report is sourced from reliable but not guaranteed sources, and its accuracy or completeness cannot be assured.

4. Any opinions or estimates expressed in this report are accurate as of the publication date and may change without prior notice.

5. WOW EARN Research assumes no responsibility for any direct or consequential losses resulting from the use of this publication or its contents.