Introduction

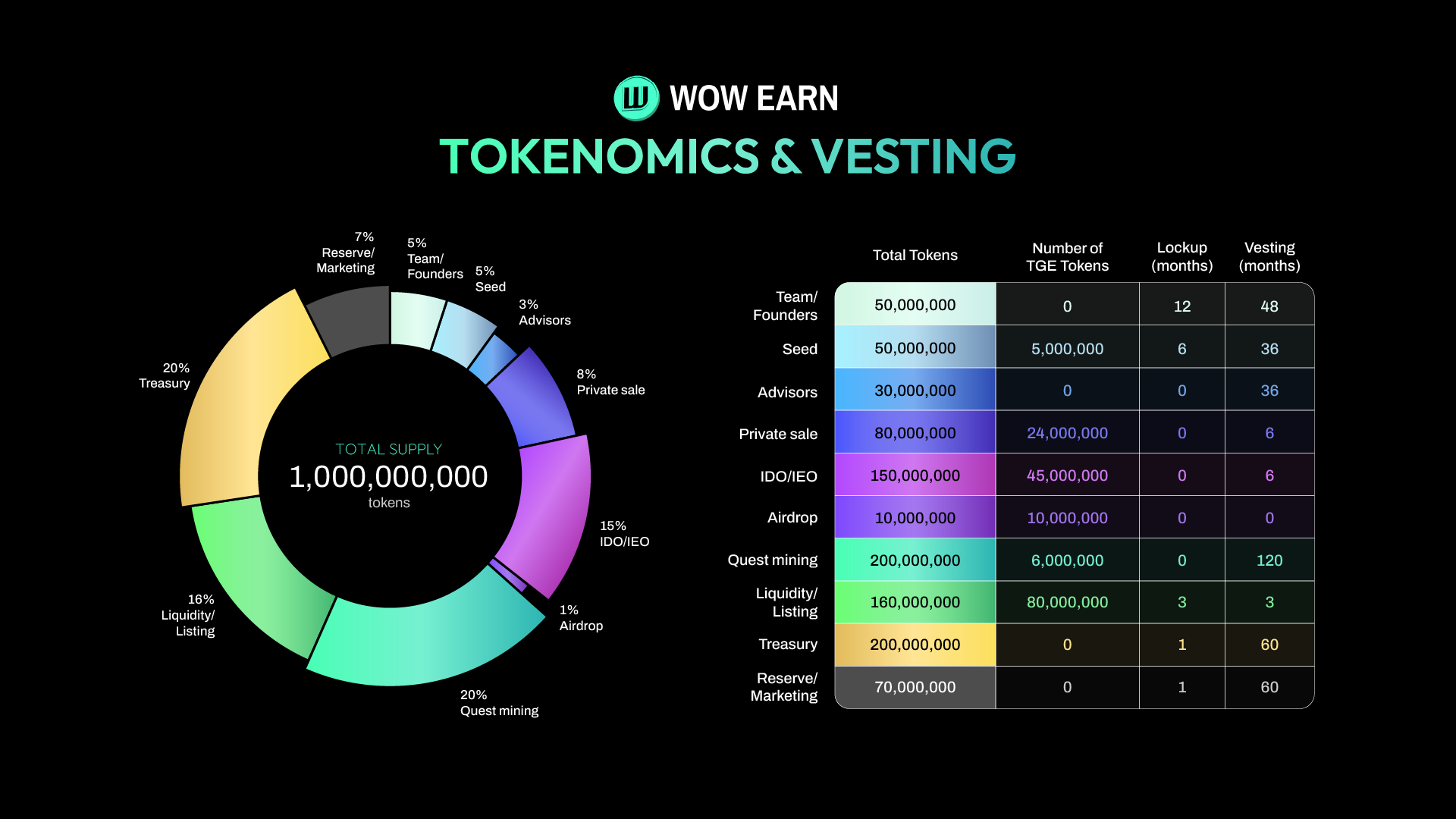

WOW EARN is revolutionizing the Web3 ecosystem with a well-structured tokenomics model that ensures sustainable growth, long-term incentives, and fair distribution. The project’s total supply of 1,000,000,000 tokens has been allocated strategically to various stakeholders, balancing market liquidity, team incentives, and community engagement.

In this article, we’ll break down WOW EARN’s tokenomics, vesting schedules, and how each allocation plays a role in building a strong and sustainable ecosystem.

Token Allocation Breakdown

WOW EARN’s token supply is divided into key categories that serve different roles within the ecosystem. Here’s how the tokens are distributed:

1. Quest Mining – 20% (200M Tokens)

WOW EARN emphasizes community engagement through Quest Mining, which rewards users for active participation. This allocation ensures a fair reward mechanism for users contributing to the ecosystem.

- TGE Unlock: 6,000,000 tokens

- Lockup: 0 months

- Vesting: 120 months (10 years)

2. Treasury – 20% (200M Tokens)

The Treasury acts as the backbone of WOW EARN, funding ecosystem development, partnerships, and unexpected expenses.

- TGE Unlock: 0 tokens

- Lockup: 1 month

- Vesting: 60 months (5 years)

3. Liquidity & Listing – 16% (160M Tokens)

Adequate liquidity is essential for smooth trading and stability. This allocation ensures a seamless listing process across centralized and decentralized exchanges.

- TGE Unlock: 80,000,000 tokens

- Lockup: 3 months

- Vesting: 3 months

4. IDO/IEO – 15% (150M Tokens)

The Initial DEX Offering (IDO) and Initial Exchange Offering (IEO) provide early supporters and investors the opportunity to participate in WOW EARN’s growth.

- TGE Unlock: 45,000,000 tokens

- Lockup: 0 months

- Vesting: 6 months

5. Private Sale – 8% (80M Tokens)

Private sale investors contribute to the early development of WOW EARN, securing funds for project expansion and adoption.

- TGE Unlock: 24,000,000 tokens

- Lockup: 0 months

- Vesting: 3 months

6. Reserve & Marketing – 7% (70M Tokens)

A portion of the supply is dedicated to marketing efforts, strategic partnerships, and promotions. This allocation ensures that WOW EARN gains traction in the competitive Web3 space.

- TGE Unlock: 0 tokens

- Lockup: 1 month

- Vesting: 60 months (5 years)

7. Team & Founders – 5% (50M Tokens)

The team and founders play a critical role in developing and expanding the ecosystem. A long vesting period ensures their commitment to the project.

- TGE Unlock: 0 tokens

- Lockup: 12 months

- Vesting: 48 months (4 years)

8. Seed Round – 5% (50M Tokens)

Seed investors provide initial capital to kickstart the project. These early supporters are rewarded with a vesting structure that balances incentives with project sustainability.

- TGE Unlock: 5,000,000 tokens

- Lockup: 6 months

- Vesting: 36 months (3 years)

9. Advisors – 3% (30M Tokens)

WOW EARN has onboarded industry experts to guide the project’s growth. Their tokens are vested over time to ensure long-term commitment.

- TGE Unlock: 0 tokens

- Lockup: 0 months

- Vesting: 36 months (3 years)

10. Airdrop – 1% (10M Tokens)

A small allocation is reserved for strategic airdrops to reward early adopters and active community members.

- TGE Unlock: 10,000,000 tokens

- Lockup: 0 months

- Vesting: 0 months (fully unlocked)

Sustainable Vesting & Lockup Strategy

The vesting and lockup schedules are designed to maintain stability while fostering long-term growth. Here’s how:

- Team & Founders have a 12-month lockup and 4-year vesting to ensure long-term commitment.

- Seed & Private Sale investors have shorter vesting periods to balance early liquidity with sustainable growth.

- Marketing & Treasury funds are released gradually over 5 years, ensuring consistent project funding.

- Quest Mining has the longest vesting period (10 years) to reward long-term ecosystem engagement.

Why WOW EARN’s Tokenomics Stand Out

WOW EARN’s tokenomics model is built with a focus on:

- Sustainability – Balanced vesting and lockup periods ensure a steady supply without market shocks.

- Fair Distribution – A diverse allocation structure benefits different stakeholders.

- Growth-Oriented – Treasury, marketing, and liquidity allocations support long-term expansion.

- Community-Centric – Quest Mining and airdrops reward early adopters and active users.

WOW EARN’s well-structured tokenomics ensures that investors, users, and stakeholders benefit from a sustainable and fair ecosystem. With strategic allocations, controlled token releases, and long-term growth incentives, WOW EARN is set to become a key player in the Web3 space.

???? Join WOW EARN’s journey and be part of the future of decentralized earning!